Our Strategy‘First Institutional’ Growth Capital

VALUE-ADDED PARTNERSHIP

Customized Private Equity Solutions

We provide bespoke solutions that create alignment with our portfolio company partners. Our goal is to help founders realize the full potential of their business without raising continuous and dilutive venture capital or exiting via a full sale prior to achieving their growth objectives.

TARGET CRITERIA

Owner Operated and Established, High Growth Companies

Target Investment Criteria

We focus on lower middle-market companies with:

$10-250MM

Revenue

$1-30MM

EBITDA

+10-20%

Growth Rate

- Capital for organic growth: Add sales & marketing resources, fuel customer acquisition, expand partnership channels, or accelerate R&D

- Capital for M&A: Pursue transformative acquisitions or industry consolidation

- Minority recapitalizations: Provide partial or full liquidity for founder, management, or employee shareholders

- Majority buyouts: Sponsor management-led change-of-control transactions or divestitures

How We Invest

A Growth Partner to bootstrapped businesses

We typically invest $15-75 million in customized private equity solutions that enable business owners to build durable and great businesses and to achieve extraordinary financial outcomes.

FOCUS ON OWNER-OPERATED BUSINESSES

A “buy in” approach to accelerate a business owner’s vision, rather than a buyout

TRANSFORMATIONAL

Value-added partnership to create a market leader in a sub-sector undergoing disruptive change

SPECIALIZATION IN TECHNOLOGY AND BUSINESS SERVICES

B2B software, industrial technology, managed solutions and technology-enabled services

Beyond Unicorns

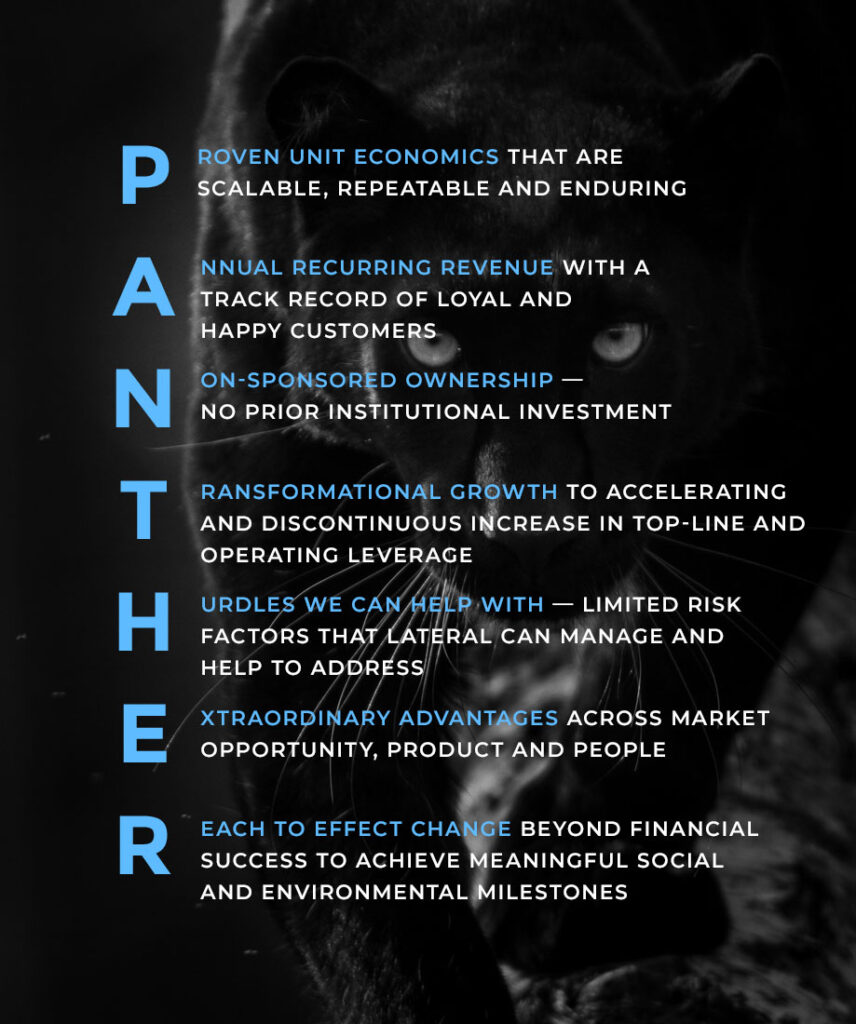

A Focus on ‘PANTHERS’

Lateral focuses on businesses that are ambitious, yet grounded in sensible and profitable business models. We call these companies “PANTHERs”.

We avoid speculative startups that seek to invent new markets or companies that have been bought and sold by multiple private equity owners. Our focus on “PANTHERs” is deliberately intended to contrast with “Unicorns,” the term coined for high-risk venture capital backed startups that are valued at over $1 billion.

The “PANTHER” companies we invest in take a conservative approach to risk and look for high probability outcomes. We help “PANTHERs” embrace challenges, navigate transformational growth, and achieve sustainable profitability.