How to Generate Alpha in Today’s Market

- Perspectives

Private Equity’s Need to Focus on Old-Fashioned Portfolio Company Business Improvements

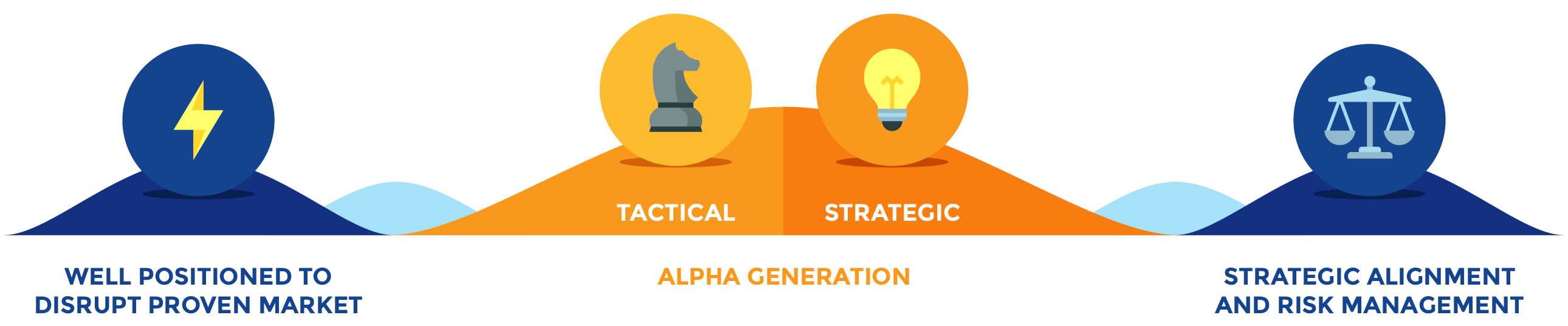

Another golden era of private equity and 10+ years of correlated record returns has come to an end. A generation of investors has grown up with a simple formula for success – the so-called “beta” trade – buying at high prices and selling at higher prices, a sure thing with ever-rising valuations, short hold times, and M&A buying sprees. Fueled by cheap covenant-light debt and expanding multiples, closing transactions was the key to success. In 2023, decelerating macro growth, rate increases, and compressing multiples, have changed the playing field. As it always does, the market has gone back to pricing risk rationally and valuation based on profitability. There is a need to refocus on organic growth and “alpha” generation. This requires a more nuanced playbook and operational toolset for PE investors, perhaps no more so than for the generation under 40 who have never seen anything but a “buy the dip” correction. In the next 10 years, PE returns will diverge widely. We see the opportunity for investors like us with a strong alpha generating playbook to distinguish ourselves in building market-leading portfolios.

Generating true “alpha” is what Lateral Investment Management has done since our founding. We focus on partnering with lower middle market companies facing transformational growth, where we can provide “first institutional” growth capital along with value-added assistance to established businesses that can be leaders in fundamental sectors such as manufacturing, business services, and infrastructure that are at the intersection of technology and disruptive change. How is our approach different? We do the hard work of focusing on six interconnected aspects of business operations – management team development and alignment, operational excellence, organic growth, margin expansion, accretive acquisitions, and cost containment.

Management Team Development and Alignment

Unlike typical buyout firms, our growth buyout strategy is owner-centric, focused on aligning interests and on empowering a business owner for success. This includes a “buy-in” phase during which the owner retains significant, if not majority, ownership from the start of our partnership. We train existing staff and make senior hires in key areas. For example, lower middle market businesses are often understaffed, have weak financial controls, and lack visibility into their key operating metrics. We assist in recruiting CFOs and ensuring they’re reporting in purposeful ways that lead to operational excellence. We help in building a board of directors, tapping our stable of operating partners with deep industry experience.

Operational Excellence

Our basic playbook relies on implementing best-in-class processes. We focus on upgrading the sales team, providing input on commission structures and lead generation activities, helping companies better manage a sales funnel, and implementing a robust CRM, all with the goal of increasing recurring revenue and margins.

For all of our investments, particularly in manufacturing, we implement KPIs and dashboards, helping to minimize waste throughout the process of delivering a product or service. We review relationships with suppliers, re-negotiating agreements and upgrading the quality of supplier relationships so they more closely resemble strategic partnerships. It all goes back to KPIs and continued improvement over time. Our overall aim is to set monthly or quarterly targets that offer steady progression towards a long-term margin goal.

Strategy Transformation

Strategy transformation is at the heart of our differentiated thesis-driven approach to generating “alpha” and transforming growing companies into market leaders. We look for opportunities to take undervalued operations and repurpose them to develop market leadership in subsectors that are undergoing disruptive change. Our goal is to take good stable companies and point them at higher value market opportunities. We can foster such growth through partnership opportunities and tuck-in acquisitions. For all the companies in which we invest, we help them build longer-term strategic mandates with their customers, professionalizing relationships that historically were often transactional in nature. For example, upgrading their point of contact at the business from an entry-level operations manager to a C-suite executive. With long-term recurring revenue partnerships, our businesses can generate defensible and higher margins to scale profitably and command higher multiples.

Margin Expansion

Our primary approach to margin expansion is to improve efficiency. In manufacturing, we focus on throughput and labor productivity, where we might aim, for example, for a 90+% utilization rate. With professional services businesses, we look to improve utilization as well as to increase prices. Many of the companies in our portfolio, such as Morae, in the technology-enabled legal services business, have significant fixed costs and profitable growth is driven by premium prices and high utilization rates. The more we are able to grow revenue, the more we can generate higher (sometimes significantly higher) margins. Part of our thesis at Morae is to transform a company from primarily a project-based to a more contract- and recurring revenue-based business. We helped Morae transform its professional services business by acquiring a complementary technology business, significantly increasing recurring revenue. We also supported the company’s expansion outside the U.S. through the purchase of businesses in the UK and Australia. With its expanded footprint and delivery capability, the business is well positioned to support, global Fortune 100 clients that can rely on one partner with global delivery capabilities.

Accretive Acquisitions

With our lower middle market focus, our portfolio companies are well positioned to buy smaller sub-scale businesses that are below the radar for other investors. And while these companies frequently require significant handholding, they can often be purchased at a significant discount to market multiples.

Typically, we make acquisitions to accelerate entry into new product lines. We are currently looking to invest in additional businesses where we can apply this acquisition playbook. For example, we're actively looking at various types of professional services firms that could subsequently acquire a technology provider, thereby increasing the company’s scalability and valuation. Technology is becoming part of a holistic service delivery solution as opposed to an end in itself.

Cost Containment

When it comes to containing costs, transparency and visibility are key. The cost of capital is a significant cost driver, particularly for more capital-intensive businesses. With banks typically lending to independent owners at higher interest rates than they offer to private equity-backed businesses, independent entities often face higher cost hurdles for investment projects. This cost differential can be significant, particularly in today’s rate environment. In some instances, a bank might decline altogether to lend to an independent lower middle market business in lieu of a sponsor-backed company. One of our primary objectives upon making an investment is to renegotiate a business’ financing agreements, including leasing and equipment financing. In some cases, the resulting cost reductions are significant. Another line item often ripe for cost-cutting is related to distribution and transportation costs. In many cases, these types of expenditures can be meaningfully simplified and rationalized.

As the investing landscape shifts from one of selling to the next highest bidder in the “beta” trade merry-go-round, to one of building unique and durable “alpha” through old-fashioned business improvements, the era of active portfolio company management has risen again, and the value of a time- and cycle-tested strategy transformation and operational excellence is more valuable than ever.